It’s official – what we’ve suspected all along – “traditional” estate agents get sellers more money in their pocket than the internet-only alternative. They also secure more viewings and offers! According to research by The Advisory, internet-only agents rely too heavily on property portals to find buyers.

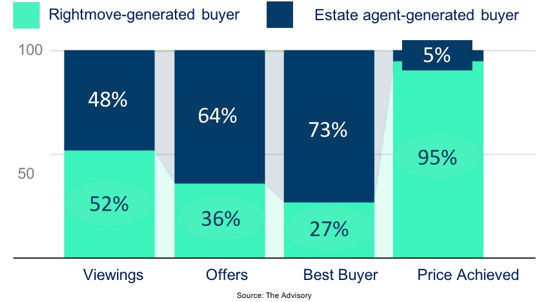

The research suggests that while Rightmove, for example, may directly generate 52% of viewings, this results in only 36% of offers, whereas High Street estate agents generate 48% more viewings, 64% more offers and, in 73% of cases, a 5% higher sale price.

On a £250,000 sale, this higher sale price translates to a loss of £12,500 if a passive intermediary (online-only) firm has been used, versus a local estate agent, as Internet-generated viewings do not engage any of the proactive interactions required to prompt a sale.

This could be the reason why professional property traders tend to use regular estate agents over internet-only agents. While internet-only agents appear to be cheaper, estate agency fees are not as important as the “walkaway figure” – the amount received from a sale after the cost of selling has been deducted. Those who use an internet agent could be “stepping over the pounds to pick up the pennies”. No wonder the market share of internet agents is no longer growing and stands at just 7.2% (Source LeadHub) with 57% of sellers who used a hybrid/online agent saying they would not do so again (source: Zoopla)

Remember, internet-only agency fees are usually payable up-front, so these “virtual agents” have no incentive to perform whatsoever. At Ruxton, we only charge on successful completion – our revenues and our reputation depend on it!

You wouldn’t try to sell your Bentley on e-Bay, so why do so with an even more expensive asset? So, if you’re thinking of selling, you know who to call. As your friendly, local, REAL estate agent, we’d love to hear from you. 0121 704 0100.